#9 Unraveling the Tale of Byju's: A Cautionary Chronicle in EdTech

Dive into the Rise, Pitfalls, and Resilience of India's Startup Poster Boy

Hello Readers,

In the exciting world of education tech, Byju's, a once highly praised name among Indian startups, has become the central figure in a tale that swings between great success and a sudden fall. It's more than a business story; it's a warning journey, a trip through big dreams, hurdles, and the tough truths of growing too fast.

The Rise: A Peek at Greatness

Just two years ago, Byju's was at its peak, valued at a whopping $22B. Endorsements from celebrities like Shah Rukh Khan and Messi made this edtech giant a symbol of hope, using technology to give educational chances to thousands. It wasn't just a business; it was a sign of new ideas and success.

The Turning Point: Urgency and Shrinking Success

Fast forward to December, and things take an unexpected turn. Byju Ravindran, the founder, takes an extraordinary step—pledging his house and getting a big loan of $12M. This desperate move, an attempt to save the company's respect, marked a big change for a company that had once been a symbol of success.

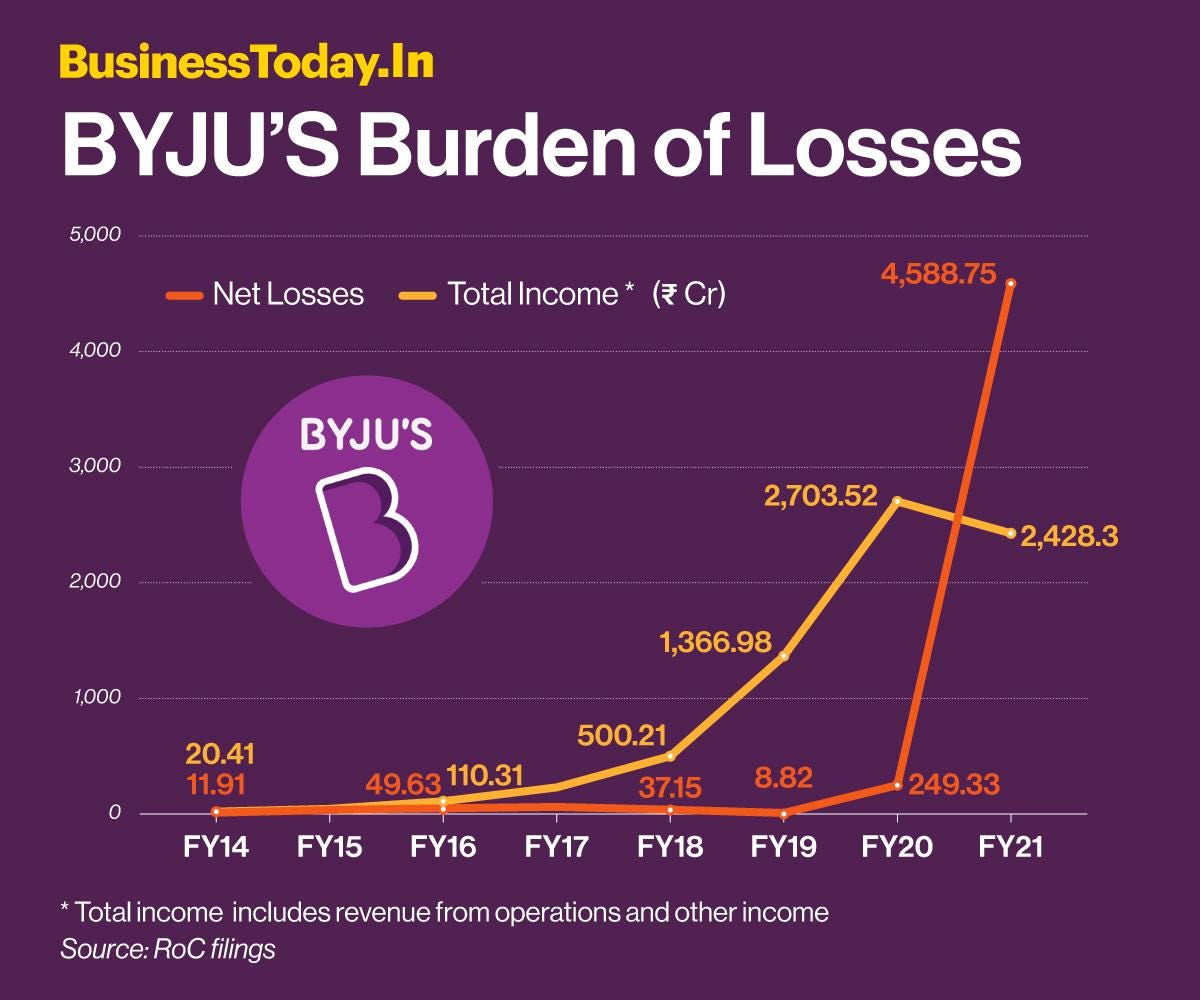

The financial trouble went beyond overdue salaries, stretching through unpaid bills, accusations of rule violations, and a drop in valuation from $22B to just $3B. The question lingered—how did this all happen?

The Unraveling: Growing Too Fast and Uncontrolled Dreams

Byju's, once a skyrocketing success, climbed to unbelievable heights before crashing in the big business sky. Its explosive story is not just a warning for tech companies but an important lesson for the whole startup world.

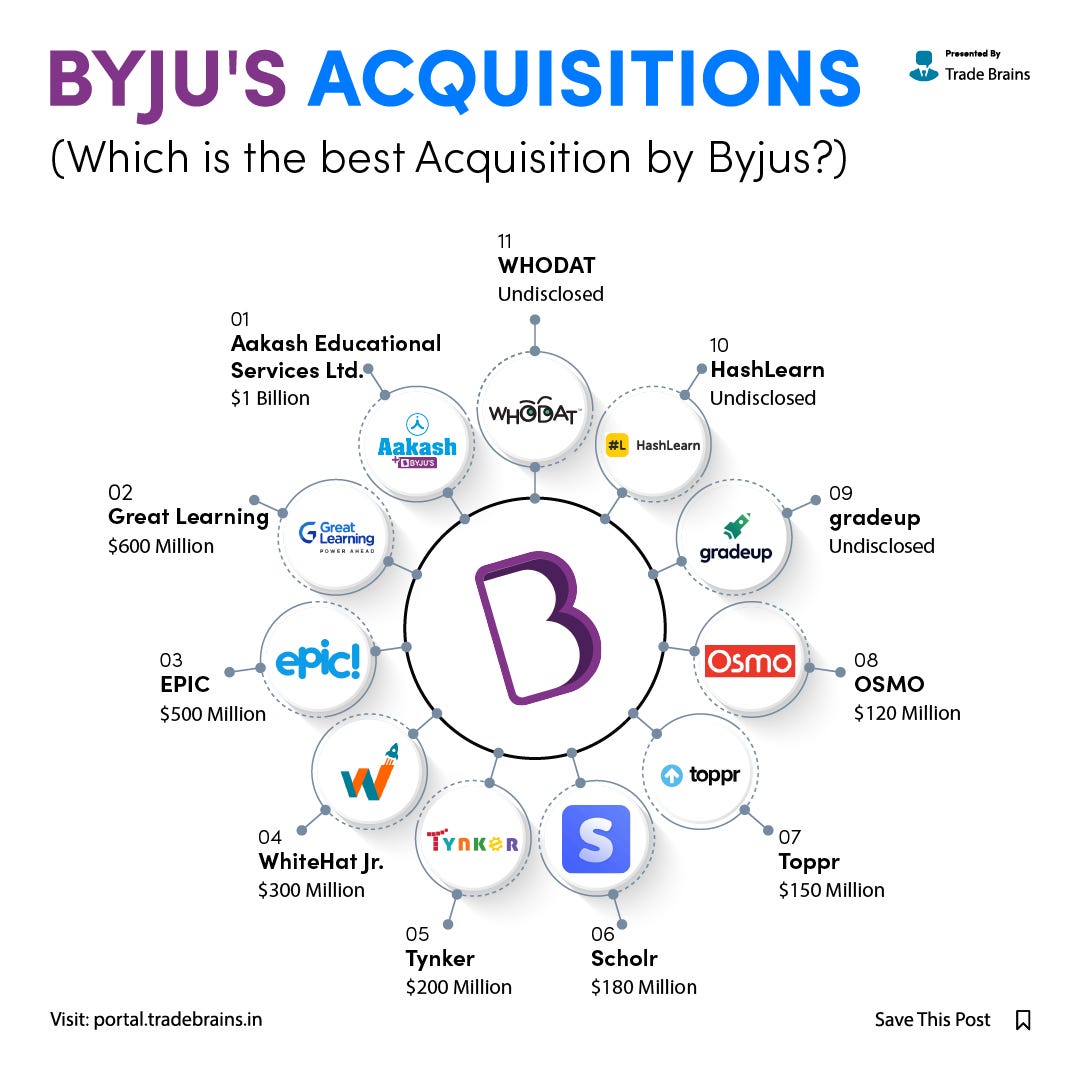

At the heart of Byju's downfall was its unstoppable drive for growth, a big ambition that led to an unsustainable business model. In its eager push for growth, the company bought many other companies without careful checks, gathering a huge debt.

Byju's acquisition spree included notable companies like Aakash Educational Services (nearly $1B), WhiteHat Jr ($300M), and Osmo ($120M). This aggressive expansion strategy significantly impacted its financial stability.

This growth without a solid base shattered the core of Byju's success story.

Once celebrated for changing education, Byju's found itself caught in claims of a bad work culture, aggressive sales tactics, and shady money practices. The employees, the backbone of the company, faced impossible goals, bad management, and an environment driven by big dreams that couldn't last.

While the COVID-19 pandemic helped edtech companies, including Byju's, the company's luck changed as schools opened, and the craze for online learning faded. At the same time, the global money scene shifted, with investors leaving risky tech markets. Byju's struggled to get funds.

Byju's risky move into buying other companies during the pandemic made things worse. These buyouts, meant to make the company stronger, used up even more money. The idea of huge growth fell apart, and Byju's hid this truth from the public for an amazing 33 months.

As the story of Byju's fall unfolds, it's clear that the once-celebrated unicorn is now stuck in legal fights, unpaid loans, and doubts about being honest. The recent use of the founder's house to get funds, seen as a symbol, only adds to the doubt about Byju's being trustworthy.

The employees, parents, and others who once believed in Byju's are now dealing with the results of its quick fall. The BCCI started insolvency measures, debts are piling up, and the trust in what was once India's most important edtech company is fading away.

Byju's, from a humble CAT coaching venture to a multi-billion-dollar edtech giant, has become a cautionary tale. Its rise and fall resonate not only in the boardrooms of tech companies but in the collective consciousness of an entire startup ecosystem. It serves as a stark reminder that blind growth, fueled by greed and devoid of ethical considerations, is a perilous path that can lead even the mightiest to a precipitous fall.

Amidst the Broader Landscape: Trends, Challenges, and Reflections

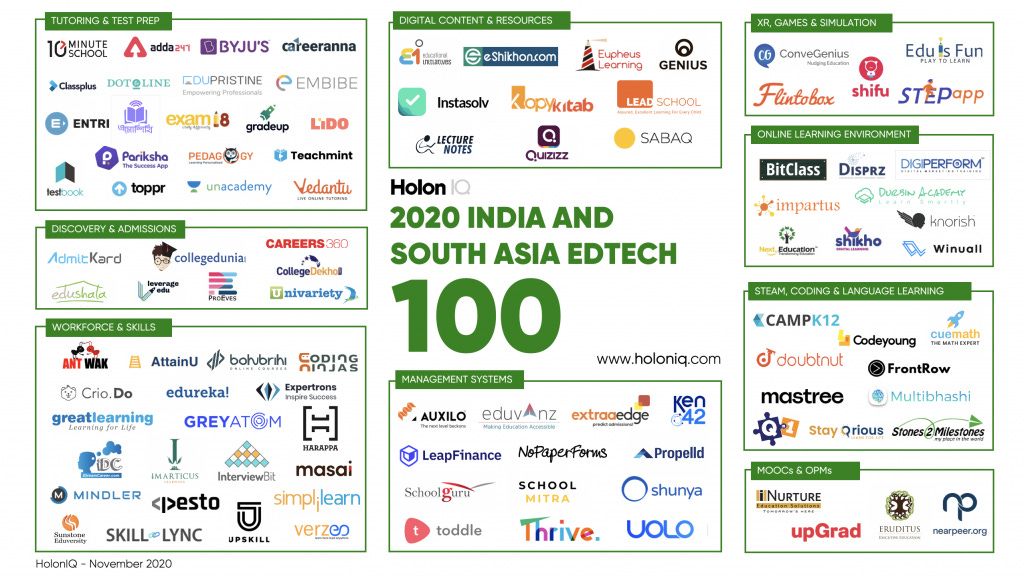

Amidst these intricacies, it's crucial to zoom out and understand the broader landscape that shaped Byju's journey. The global edtech market witnessed remarkable growth, valued at around $90B in 2020, projected to reach $285B by 2027. Byju's, too, rode the wave of this global trend, capitalizing on the surge in interest and investments in the Indian edtech sector.

In 2020, Indian edtech startups received over $2.22B in investments, showcasing a booming interest in this sector. Byju's, in its journey, secured approximately $3.5B in funding over 18 rounds by 2021. Key investors included the Chan Zuckerberg Initiative, Tencent, Sequoia Capital India, and Tiger Global Management. However, its aggressive acquisition strategy, with notable ventures like Aakash Educational Services, WhiteHat Jr, and Osmo, significantly impacted its financial stability.

The COVID-19 pandemic played a pivotal role in Byju's short-term growth, reporting a 200% increase in new students during the lockdown. Yet, as schools reopened, a noticeable shift back to traditional learning impacted online platforms like Byju's. The company claimed over 80M registered users by 2021, with 5.5M annual paid subscriptions and reported revenue of around $388M in the fiscal year 2020.

Employee and work culture issues surfaced, with reports indicating high-pressure sales tactics and a stressful work environment. Glassdoor reviews and media reports highlighted employee dissatisfaction and high attrition rates. The rapid rise to a $22B valuation marked by optimism in the edtech sector was followed by a drop reflecting not just company-specific issues but also a broader market correction in tech valuations post-pandemic.

The Indian government's focus on regulating the edtech sector, with guidelines to prevent unfair trade practices and ensure transparency, added another layer of challenge for Byju's operations. It operates in a highly competitive market with players like Unacademy, Vedantu, and international platforms like Khan Academy and Coursera influencing its business strategies.

Amidst these intricacies, the effectiveness of Byju's courses faced mixed reviews, with some parents and educators questioning pedagogical approaches and long-term educational outcomes. The story of Byju's, once a symbol of innovation and success, now serves as a multifaceted narrative, intertwining global market trends, financial complexities, regulatory challenges, and the imperative need for ethical business practices in the ever-competitive world of edtech.

In Retrospect: Lessons and Reflections

As we reflect on this journey, Byju's story beckons us to question, scrutinize, and learn from the mistakes of blind ambition. It underscores the importance of transparency, ethical business practices, and a sustainable model for long-term success. Byju's, once a symbol of hope, is now a cautionary beacon, urging us all to tread carefully in the volatile landscape of business and innovation.

I’ll continue to keep you updated on the unfolding saga, exploring the nuances, lessons, and broader implications for the edtech sector. Stay tuned for more insights and reflections.

Best regards,

Arin Verma

BUSINESSBUZZ

Source: Think School, The DeshBhakt, WION, Hindu and a few more.

Follow me on Twitter, LinkedIn, Instagram for interesting insights about businesses, startups and technology!

Share it with your friends and family if you enjoyed reading this :) and stay tuned for more interesting insights on businesses and technology!