#4 From $50B to $270M - Why did WeWork have such a tragic downfall?

This is what happens when founder starts living a lavish lifestyle with funding that was supposed to run the business.

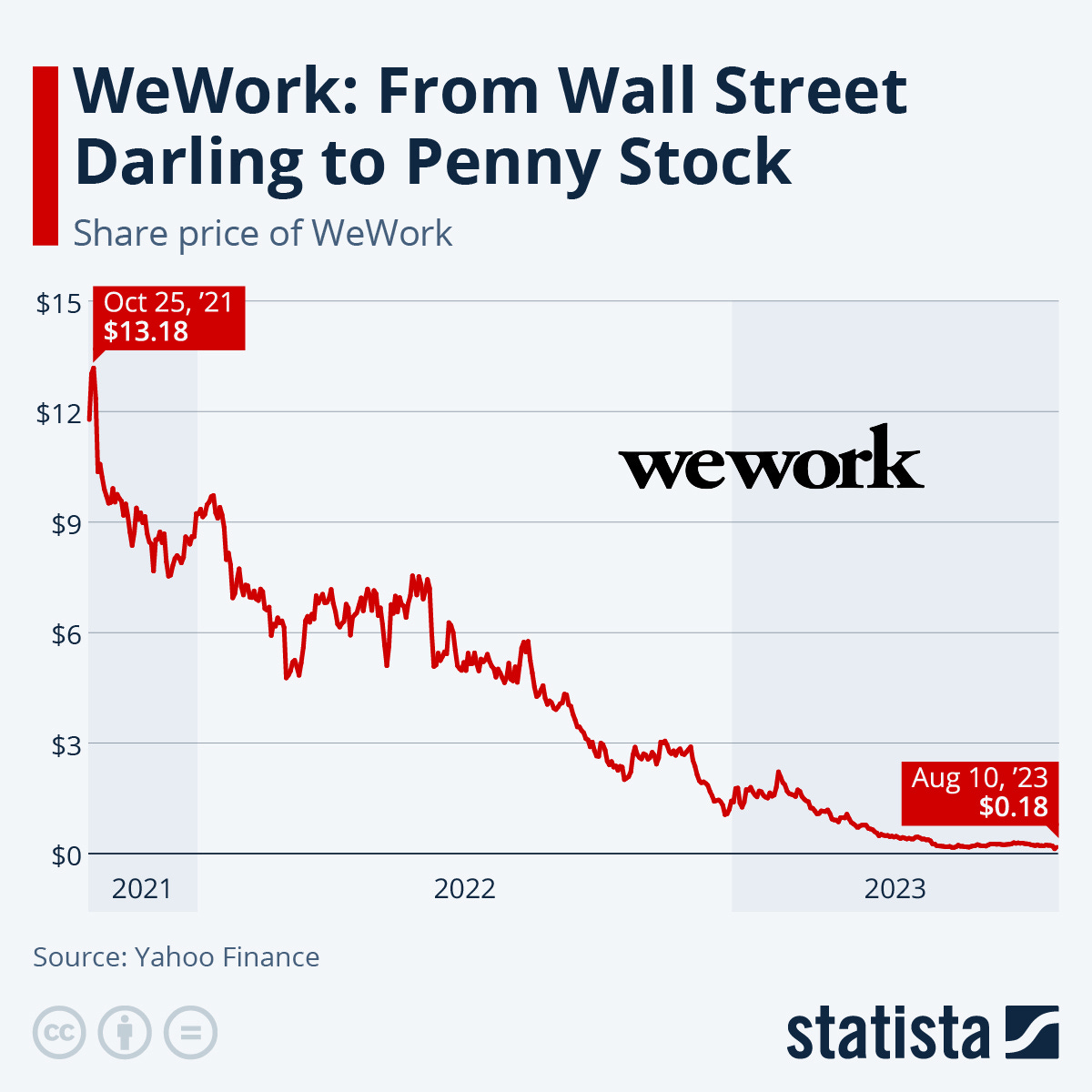

Back in the mid-2010s, when work felt like a big party, WeWork was the place to be. It had cool stuff like beer, tacos, and live concerts, making it super popular. Investors even thought it was worth a mind-boggling $50 billion in 2018. But today, WeWork's shares are barely worth 20 cents(down by 99%), and it's close to going bankrupt. People are talking about it on social media, but not in a good way.

So, what went wrong with WeWork, the company that made shared office spaces famous?

WeWork's idea was simple: they rented office buildings, made them look great, and offered everything a company might need, like desks, coffee, and meeting rooms. They made it all sound very exciting. Then, they rented these spaces to startups who didn't want to deal with boring office stuff.

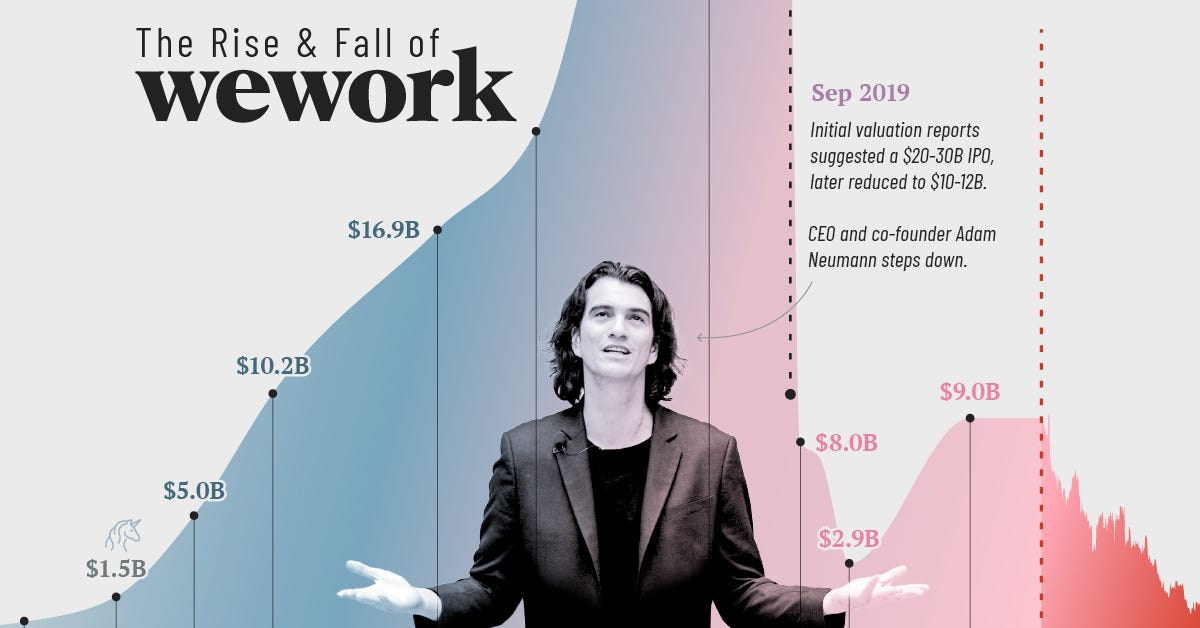

But you might wonder, how did a company that seemed like a real estate business get valued at $50 billion, like a fancy tech company? Well, the trick was storytelling, and WeWork's founder, Adam Neumann, was a fantastic storyteller. In 2010, after the 2008 financial crisis, he sold a dream. He said, "Stop relying on big companies, become an entrepreneur!" He called WeWork a "physical social network," where people could meet and work together, like they do on Facebook and Twitter. He said the market they could reach was worth nearly $3 trillion, including anyone who worked at a desk.

Investors loved this story, even though it was basically just renting desks. Even SoftBank's CEO got excited and told Neumann to dream big.

WeWork listened and became "We," expanding into design, apartments, gyms, and schools. This justified its huge valuation. But the losses piled up. In 2017, WeWork made $886 million but lost $883 million. In 2018, it got worse, with $1.9 billion in losses against $1.8 billion in revenue. It was losing $1 for every $1 it made!

Neumann's lavish spending, like private jets and office parties, added to the losses, but the real problem was the business model. They rented buildings for a long time but offered short-term rentals to companies. If startups decided to leave, WeWork had empty spaces and bills to pay.

Soon after, in October 2018, a troubling lawsuit came to light. Ruby Anaya, a former WeWork director, alleged sexual harassment. She claimed that during a company event in January 2018, a male colleague had made unwanted advances, forcibly kissing her, and that in a separate incident in August 2017, another employee had acted inappropriately.

Anaya's lawsuit not only shed light on what she called the company's "frat-boy culture" but also accused co-founder Adam Neumann of plying her with tequila shots during her interview. WeWork reacted by putting an end to its unlimited beer policy for employees and limiting them to just four beers per day in the New York office.

Investors didn't seem to care, caught up in the excitement. Until 2019, when WeWork tried to go public, but nobody wanted to invest in a company that was losing money. Neumann's questionable real estate dealings made things worse.

Then came WeWork's downfall. The IPO was canceled, and Neumann was kicked out as CEO, but it was too late. The company was drowning in debt and problems. By the end of 2022, they owed $15 billion in rent and had over $3 billion in loans. Bankruptcy was looming.

So, WeWork's past is full of big dreams, money problems, and fancy stories. Its future might be about learning from mistakes and finding a way to keep going.

Lets see what in there for WeWork after its catastrophic downfall :(

References:

[1] Finshots

[2] Wikipedia

[3] Time

Follow me on LinkedIn:

https://www.linkedin.com/in/arinverma