#11 The Rise Of Indigo Airlines: A Case Study on Indian Aviation

Flying High, Falling Hard: The Turbulent Journey of India's Aviation Giants and the success story of Indigo

Introduction

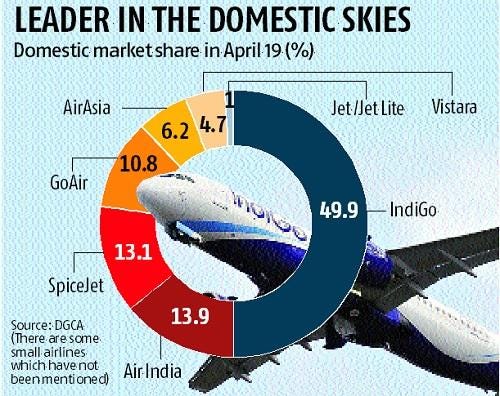

The Indian aviation industry, known for its tough competitive landscape, saw the fall of several major players like Kingfisher, Jet Airways, Sahara Air, and Deccan Air over the past decade. Amidst this, Indigo Airlines emerged as a dominant force, maintaining profitability for ten consecutive years up to 2018. This case study explores how Indigo achieved this remarkable feat in a challenging market.

Background: The Indian Aviation Market

The Indian aviation space is tough for businesses due to high operational costs and price-sensitive customers. Despite the need for substantial investment, the cost of flying in India hovers around a price point beyond which most customers can't afford, limiting the scope for premium pricing.

Broader Industry Problems: The Case of Kingfisher Airlines

Luxury Over Practicality

Kingfisher Airlines, launched by Vijay Mallya in 2005, sought to redefine air travel in India by offering an unparalleled luxury experience. This ambition reflected in various aspects of their service, such as high-quality in-flight amenities, hot meals, and entertainment systems. Kingfisher quickly became a preferred choice for business-class travelers seeking a premium experience.

Challenges Faced:

Rising Operational Costs: The luxury offerings significantly increased the operational expenses. These costs encompassed everything from the high-quality meals to the maintenance of entertainment systems.

Competition Pressure: Kingfisher faced intense competition from other airlines that offered more cost-effective travel options. In trying to maintain its luxury status, Kingfisher struggled to keep ticket prices competitive.

Market Mismatch: The Indian aviation market, primarily dominated by middle-class travelers, was more price-sensitive than luxury-oriented. This mismatch led to a smaller customer base for Kingfisher.

Acquisition Misstep

In an ambitious move, Kingfisher acquired Air Deccan in 2007 and rebranded it as Kingfisher Red, intending to cater to both the luxury and budget travel segments.

Implications:

Brand Dilution: The acquisition diluted Kingfisher’s luxury brand identity. Customers began to associate Kingfisher with the budget service of Air Deccan, leading to confusion in the market.

Financial Strain: The acquisition added to Kingfisher’s financial burden. Integrating two fundamentally different operations - luxury and budget - proved costly and inefficient.

Operational Challenges: Managing two distinct segments within the same brand led to complexities in operations, further straining the financials of the company.

Governance Issues

Under Vijay Mallya's leadership, Kingfisher Airlines experienced significant governance issues that contributed to its downfall.

Key Issues:

High CEO Turnover: The frequent change in leadership prevented the establishment of a stable strategic direction. For instance, the first CEO, Alex Wilcox, resigned within two months due to differences in vision.

Lack of Clear Strategy: There was no coherent long-term strategy for the airline. Decisions seemed reactive rather than part of a planned approach, leading to inconsistent service and brand perception.

Dependency on Mallya's Vision: The airline heavily relied on Vijay Mallya’s personal vision and style, which didn't always align with market realities or operational efficiencies.

The Emergence of Indigo

Indigo entered the market in 2005, a time dominated by giants like Jet Airways and Deccan Air. While other airlines struggled with losses, Indigo managed to turn profitable by 2008, marking the start of its journey to becoming an aviation monopoly in India.

Indigo Airlines' Four Strategic Decisions

1. Massive Aircraft Order

In 2005, Indigo made a bold move by ordering 100 Airbus aircraft. This was a significant and risky investment, especially for a new player in the aviation industry.

Depth of Strategy:

Timing & Market Position: Airbus was losing its foothold in India due to past accidents. Eager to regain its market position, Airbus was likely willing to offer substantial discounts to secure a large order from Indigo.

Volume Discount: By ordering in bulk, Indigo capitalized on economies of scale. The per-unit cost of aircraft would be significantly lower compared to ordering a few planes.

Example: Suppose the list price of an Airbus is $100 million. By ordering 100 aircraft, Indigo might have negotiated prices down to around $85 million per aircraft, leading to massive upfront savings.

2. Efficiency Over Luxury

Indigo focused on being a low-cost carrier. Unlike Kingfisher and Jet Airways, which offered luxury experiences, Indigo aimed to provide basic, efficient services.

Depth of Strategy:

Cost Savings: Reducing in-flight amenities like meals and entertainment systems lowered fuel consumption (less weight) and operational costs (less staff and maintenance).

Price Sensitivity: Understanding that the majority of Indian consumers are price-sensitive, Indigo targeted the largest market segment that values affordability over luxury.

Example: If in-flight services cost $10 per passenger, removing these on a 180-seat aircraft saves $1,800 per flight. This cost-saving could be passed on to customers in the form of lower ticket prices, attracting more passengers.

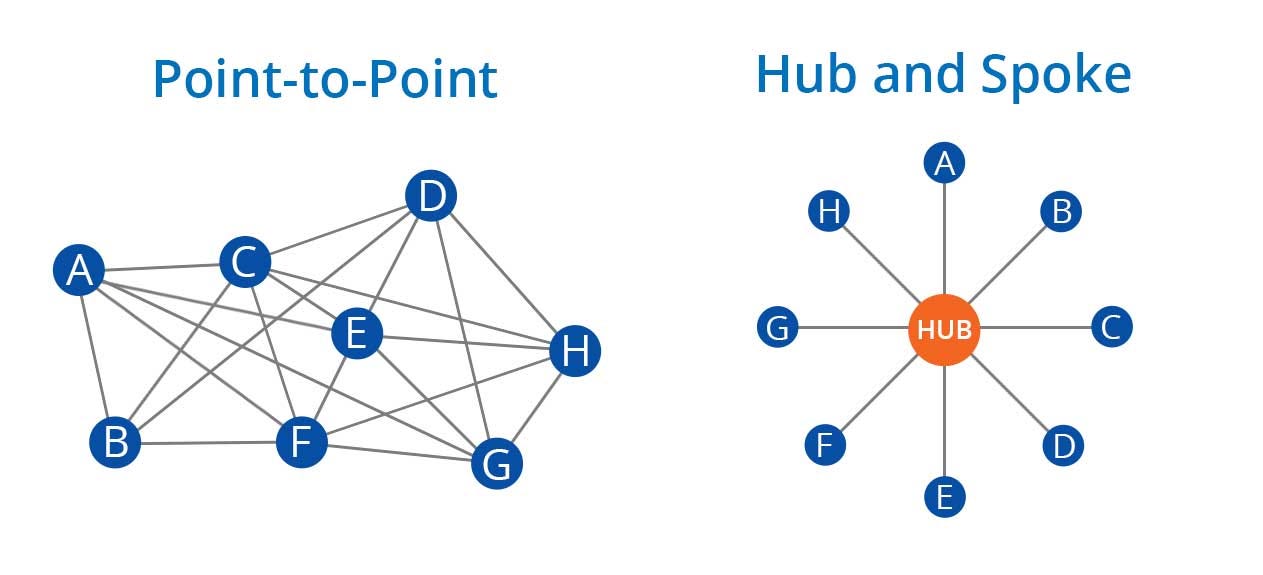

3. Hub and Spoke Model

Indigo adopted the hub and spoke model instead of the point-to-point model. This model centralizes flights to a hub, facilitating connections to various destinations.

Hub and Spoke model: Imagine a wheel. All the destinations are located on the rim while one central/main city is located in the center where all the flights depart from or arrive.

Point to Point: Simple flight movements from one point to another.

Depth of Strategy:

Increased Flight Occupancy: Centralizing flights increases the probability that each flight operates at or near full capacity, maximizing revenue per flight.

Reduced Operational Complexity: Managing a hub is logistically simpler than managing multiple point-to-point connections, leading to lower operational costs.

Example: For six destinations (A, B, C, D, E, F), the point-to-point model requires 15 direct flights. The hub and spoke model could connect all these destinations with just six flights, significantly reducing the number of aircraft needed.

4. Sales and Leaseback Model

Indigo bought aircraft at a discount and immediately sold them to leasing companies, then leased them back for operations.

Depth of Strategy:

Immediate Profit: This approach allowed Indigo to make an immediate profit from the difference in the purchase and sale price of the aircraft.

Reduced Capital Expenditure: Leasing the aircraft rather than owning them outright reduced the capital expenditure, freeing up cash for other operational uses.

Flexibility: Leasing provides flexibility to upgrade or change the fleet without the burden of owning outdated or surplus aircraft.

Example: If Indigo bought an aircraft for $50 million (discounted from $100 million) and sold it to a leasing company for $55 million, it earned a $5 million immediate profit. Then, leasing it back means Indigo operates the aircraft without the initial high capital expenditure.

Key Lessons from Indigo Airlines' Success

Lesson 1: Importance of Cost-Effective Operations

Lean Operations: Indigo’s success was significantly attributed to its lean operational model. This approach meant reducing unnecessary expenditures that don't directly contribute to the primary service - flying passengers from one point to another.

Direct Impact on Ticket Pricing: By saving on operational costs, Indigo could offer competitive ticket prices. This pricing strategy was crucial in a price-sensitive market like India, where even a small difference in fare could influence customer choice.

Example:

If Airline A offers in-flight meals and entertainment but charges $100 for a ticket, while Indigo offers a no-frills flight at $80, most budget-conscious customers will choose Indigo. This choice is driven by the $20 savings, which is significant for a large segment of Indian travelers.

Lesson 2: Learning from Competitors' Mistakes

Market Observation: Indigo meticulously observed the failures and challenges faced by its competitors like Kingfisher, which stretched itself thin by trying to offer a luxury experience in a cost-sensitive market.

Adaptation and Improvement: Instead of repeating these mistakes, Indigo chose a different path that prioritized operational efficiency over luxury. They understood that in the aviation industry, particularly in a developing market, operational cost-effectiveness is crucial for long-term survival.

Example:

Kingfisher Airlines, known for its luxurious approach, failed because it couldn't sustain the high operational costs. Indigo learned from this and instead focused on being a low-cost carrier, which proved to be a more sustainable model in the Indian context.

Lesson 3: Turning Crisis into Opportunity

Agility and Adaptability: The 2008 global financial crisis and the subsequent rise in fuel prices severely impacted all airlines. However, Indigo’s agile business model and operational efficiency turned this crisis into an opportunity.

Financial Resilience: Indigo's strategic decisions like the sale and leaseback model ensured they had a healthier cash flow, which provided them the resilience to weather the storm better than their competitors.

Example:

When fuel prices skyrocketed, airlines with higher operational costs struggled to stay afloat. Indigo, with its lower costs and cash reserves, not only survived but managed to turn a profit. This period saw them gain market share as competitors faltered.

Conclusion

The story of Indigo Airlines is a compelling case study in strategic foresight, operational efficiency, and market adaptability. Their approach to understanding and responding to market needs, learning from the environment, and maintaining financial health has made them a standout success in the volatile aviation industry. These lessons serve as valuable insights for businesses in any sector facing similar market dynamics and challenges.

I’ll continue to keep you updated on the unfolding saga, exploring the nuances, lessons, and broader implications for many more businesses. Stay tuned for more insights and reflections.

Best regards,

Arin Verma

BUSINESSBUZZ

Source: Think School, Mohak Mangal, Economic Times and a few more.

Follow me on Twitter, LinkedIn, Instagram for interesting insights about businesses, startups and technology!

Share it with your friends and family if you enjoyed reading this :) and stay tuned for more interesting insights on businesses and technology!